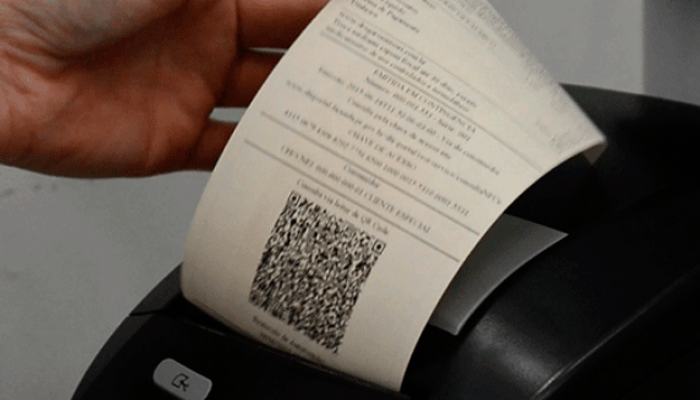

Once printed, the DANF-e must be placed on the truck with the shipment.

#Nota fiscal eletronica pdf

This PDF is called a DANF-e (Digitally Authorized Nota Fiscal Eletronica) which is a paper representation with bar codes embedded.

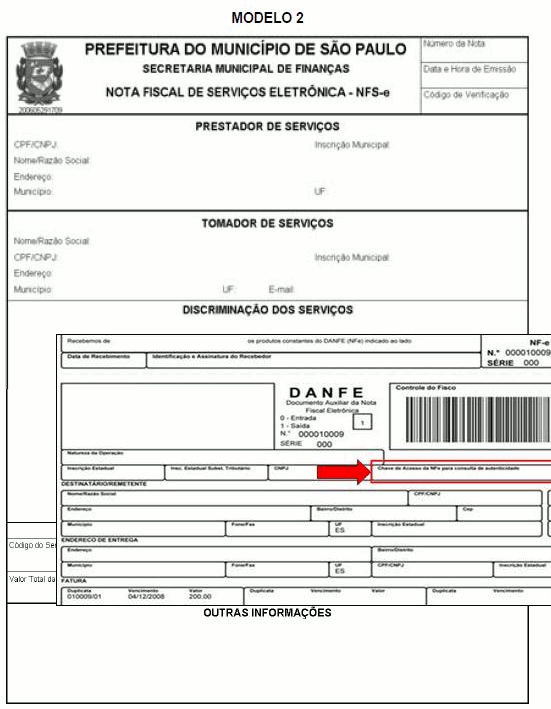

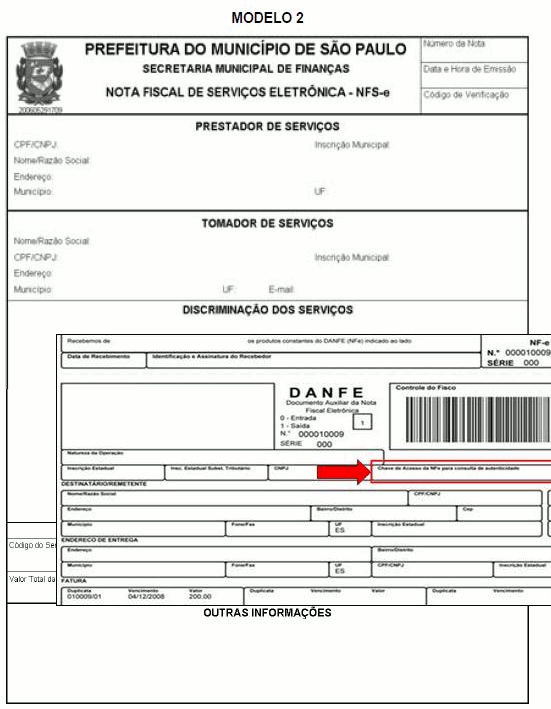

The supplier would receive the approved XML invoice back from the SEFAZ, and print out the physical representation of the invoice. The SEFAZ receives the signed XML invoice and will validate and assign the "signing attribute" (also known as approval codes) in real time, which must be posted back to the XML and ERP system prior to the release of goods. Note: most organizations are utilizing cloud services to manage this connection. This signed XML is then sent to the SEFAZ via a third party service or via direct integration. The supplier must be able to produce the appropriate XML approval document from their ERP system and sign the XML invoice with their private key. Once approved, the government will provide the supplier with a private key that can be used as the electronic signature. This is much like registering for a passport. Supplier registers for signing certificates with the government. **Note: Entire process should be archived, logged, and available via a web portal if any discrepancies or investigations are undertaken by government officials. Here is Brazil's 7-Step Process for NF-e physical goods: If you are utilizing a 3PL or freight forwarder, then these transportation invoices must be validated by the buyer and posted in the back-end system and included in their monthly reports to the government. CTe: (or more simply, Transportation Invoices) This is a newer requirement for many companies. A supplier of services will send the invoice to the city, the city will apply the appropriate legislation, and a buyer will pick up their invoices directly from the city websites. if I invoice from Sao Paolo, then Sao Paolo is the city of issuance) is the connectivity point. This means that the city of issuance (i.e. Instead of having to integrate at the state/national level, service invoices are managed at the city level within Brazil.

NFE-s for Services: I find services invoices are the most misunderstood by global corporations.

To comply with the mandates, there are a minimum of 21 states and a national fallback web service called DPEC that must be integrated. And for suppliers can be the most complex, as the truck cannot leave the warehouse until the approval codes are incorporated into the process and printed out and put on the truck (the output is called a DANFe).

NFe for Physical Goods: This is the nota fiscal that most organizations will utilize. But there are really three different kinds of invoices: This "Nota Fiscal Eletronica" (NF-e) format is officially recognized as the sole and only invoice document of record for tax compliance purposes. This is a little cheat sheet that every finance, AR and AP manager can use to start to understand the complex mandates for Brazil Nota Fiscal.įirst, it is important to understand that the Brazil tax authority, also known as SEFAZ, imposes a defined electronic standard format that all companies must adhere to closely. In all of my travels and meetings, I find that not only is the entire Brazilian eInvoicing process confusing to most companies, but they don't have a high-level understanding of the basic requirements. Spend Matters welcomes a guest post from Steve Sprague, Vice President, Marketing & Product Strategy at Invoiceware International.

0 kommentar(er)

0 kommentar(er)